huawei.indah.link

For a fleeting few bright moments in April, May and June 2020, Huawei reigned supreme as the world's largest smartphone maker, shipping 55.8 million smartphones.

South Korea's Perennial champion, Samsung, found itself taking an unaccustomed silver, shipping 53.7 million units in the second quarter, in Canalys's count. And then the US-China tech trade war came, and Shenzhen's swan song ended.

(Kicking dust in its wounds, Gartner then totted up the second-quarter results slightly differently, suggesting on the recount Samsung clung onto its lead with 54.75 million units, a nostril ahead of Huawei's 54.12 million.)

Its revenue for the first nine months of the year, 671.3 billion yuan ($100.6 billion), represented a healthy 9.9% improvement from the same period of 2019. But if you consider last year at this point, the first nine months were up 24.4% from that period in 2018, you see that things are cooling off a bit in Ren Zhengfei's company.

It was a result that "basically met expectations," said Huawei in the terse announcement.

My way or the Huawei

The US Secretary of State, and AC/DC fan, Mike Pompeo, appeared on a highway to hell to drive Huawei from the world's 5G networks.

Huawei, instead of topping world smartphone sales tables, found itself instead starring center stage in a new tech cold war between Washington and Beijing.

In mid-May, US President Donald Trump's administration announced companies would need to receive government licenses before selling Huawei any microchip made using US equipment or software.

This was fighting talk, and faced with losing access to the lucrative US market, chipmakers like Taiwan's TSMC quickly folded.

And in the face of the hot oven of US pressure, even European governments – which previously had politely rejected Trump's more livid characterizations of Huawei as a pawn of the Chinese state and its security establishment – over the summer months ultimately showed Huawei the door, too.

Within the US, Huawei faced tightened export restrictions in August, and then in a November "rip and replace" order from the Federal Communications Commission (FCC). Telecommunications companies would need to remove Huawei equipment from their networks, said the regulator.

But this required stumping up at least $1.6 billion for making the changes, since many telcos are propped up by US federal subsidies to provide network services in rural areas of America. Dutifully, the US Congress said it would set aside $1.9 billion to replace telecom equipment from Huawei and ZTE.

The pennies form part of a mammoth $900 billion COVID-19 relief bill which has just wended its way through Congress. (Even though Trump has decided he may not sign it.)

The Huawei ahead

So instead of giving Samsung a thrashing, Huawei's been reduced to scouring other sources of chips to serve its core markets like mainland China.

Its $413 million investment fund, Hubble Technology Investment, has acquired minority stakes in three Chinese semiconductor companies in the last three months. Some of these stakes are very strategic: like an October 3.3% in Skyverse, which gives Huawei access to lines of technology that aren't dependent on US permissions.

Want to know more about security? Check out our dedicated security channel here on

Light Reading.

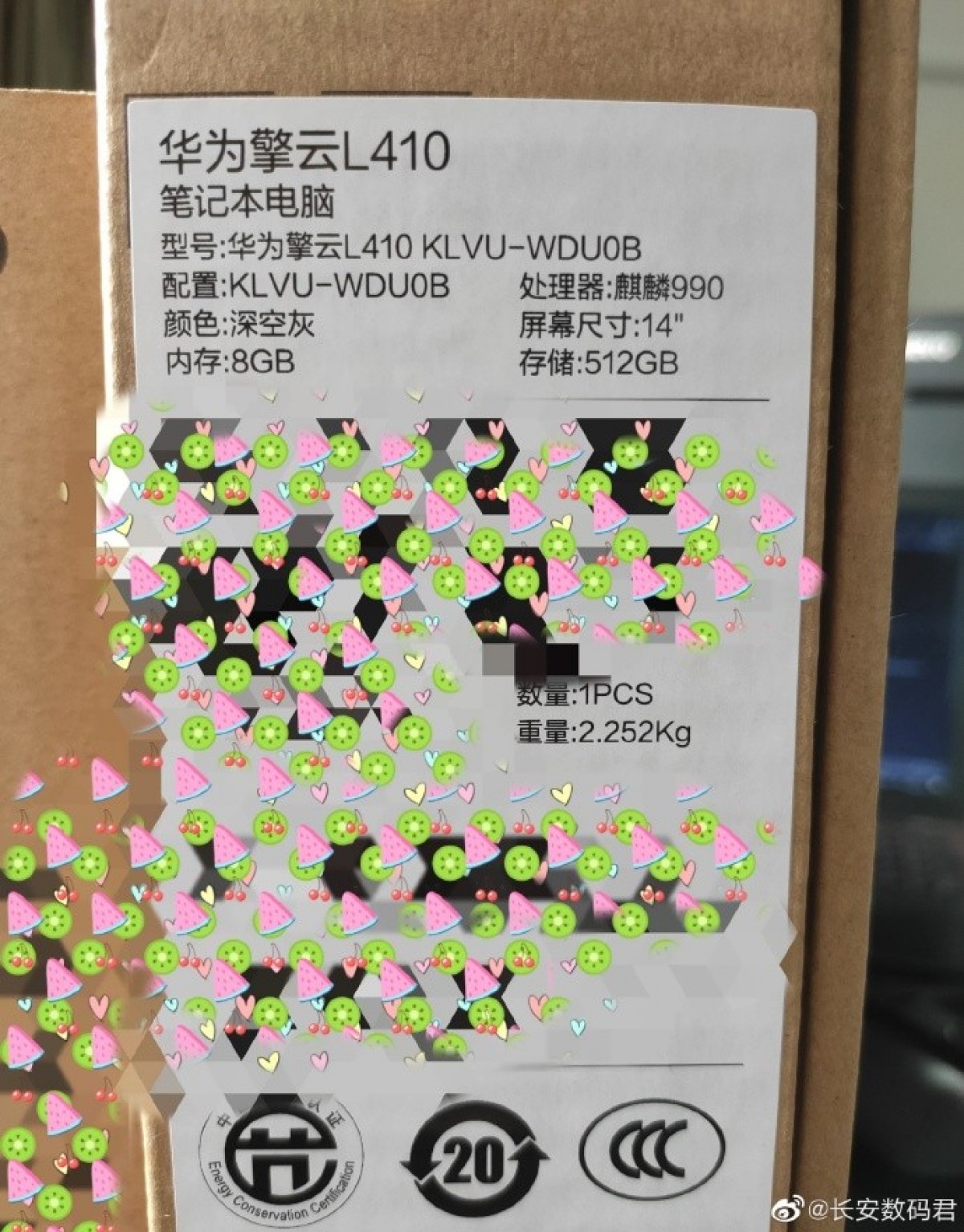

Meanwhile Huawei effectively conceded its aspirations to unset Samsung for the top seat. In October it offloaded its more budget offering, the Honor smartphone unit, so that business could grow unfettered by US sanctions.

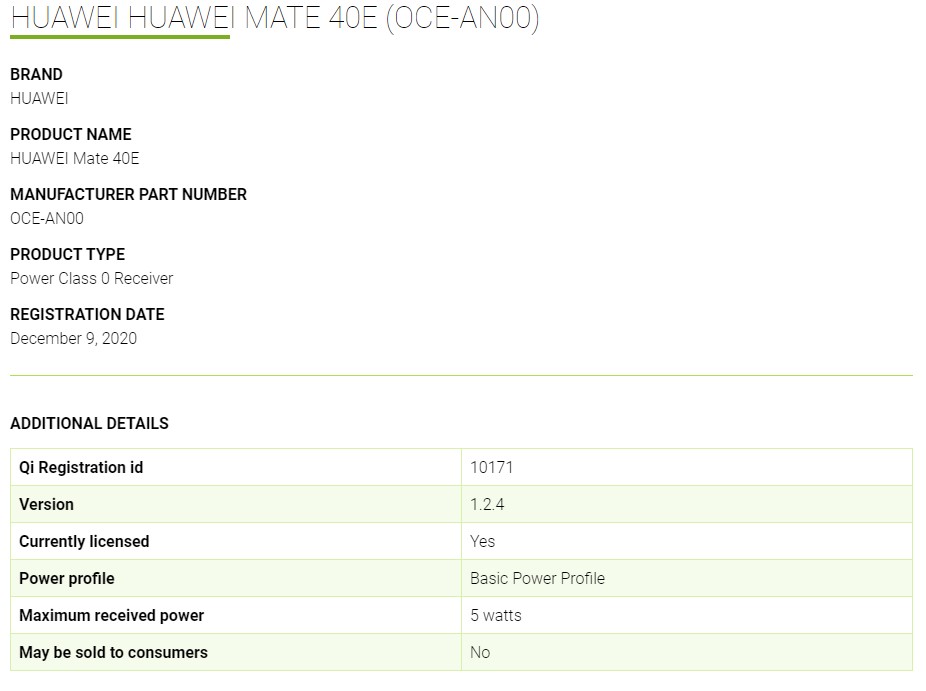

And its new high-end smartphones like the P40 Pro and the Folding Mate X have impressed consumers and journalists worldwide.

But if western users won't be able to access Google services with them, then $2,400, for the Folding Mate, might seem a lot to pay. Like any good Chinese tech company, Huawei's also happy to cast its net broadly: looking at cloud and AI partnerships with Saudi Arabia, and smart expressways in Laos.

So don't count Huawei out in 2021.

But also don't underestimate the work it has cut out ahead in creating a dedicated domestic chip supply chain out of a number of minnow players.

And if the incoming Biden administration surprises us and takes a much more conciliatory stance toward China, then Huawei might even get back to breathing down Samsung's neck again.

Related posts:

— Pádraig Belton, contributing editor special to Light Reading

The Link Lonk

December 28, 2020 at 08:30PM

https://ift.tt/3n0VZtS

To Huawei, 2020 gave a brief crown and a trade war - Light Reading

https://ift.tt/3eIwkCL

Huawei

Dear Reader,

Dear Reader,