Barcroft Media via Getty Images

Huawei is about to shift the 600 million users on its smartphone ecosystem from Android to its own HarmonyOS/HMS—at least that’s what seemed to be the key takeaway from HDC, the company’s developer conference a week ago. Well—maybe not. The real takeaway from HDC is much more interesting and will be a much more serious threat to Android than just shifting Huawei users. If it works, of course.

The reason Huawei is venturing an alternative to Android is the U.S. blacklist pulling Google software from its devices. That same blacklist has now removed chipsets and displays. There’s not much point in a new OS if smartphones are in short supply. The biggest threat to Android is not Huawei users shifting OS, it’s a potential market shake-up that impacts many more manufacturers than that.

Huawei has painted this shift from Android as an industry game-changer, a strike against Google and archival Samsung, fuelling the company’s ambition to “fight” Android head-on “and take the lead.” Huawei overtook Samsung for global smartphone shipments earlier this year, albeit temporarily. The new U.S. action ensures that Samsung, as Android’s leading light, will recapture the market lead. Huawei’s ambition had been to topple Samsung’s crown. Now it needs to adopt an entirely different strategy to attempt the same.

At HDC, these game-changing supply chain issues were played down. Huawei’s consumer boss, Richard Yu, mentioned “restrictions and software shortages” in among an upbeat summary of “booming” sales, number one or two—globally and in China—in wearables, watches and notebooks. Number three for tablets. And, above all, number one—both globally and in China—for smartphones. For now, at least.

Richard Yu, Huawei HDC 2020

HuaweThe U.S. first blacklisted Huawei in May last year, with the loss of Google being the headline. That tanked export sales for new Huawei phones, but its domestic market grew and grew. A year on, in May this year, the U.S. prohibited Huawei from using American tech to design or fabricate the custom chips that power its flagships. Plan B was to turn to standard offerings. Painful but not existential. Then, in August, Washington played its Trump card. Suddenly those third-party chips would also be restricted. There’s no obvious Plan C.

So let’s return to Yu’s bullish presentation. Yes, “our business has been affected,” he said, but “we can see our business is still growing fast.” Surely this means the company has a clever plan to replace those smartphone chipsets? That would mean the reported 75% decline in smartphone shipments next year, down to some 50 million units, must be very wrong. So, is there a secret Plan C after all?

Actually, there probably isn’t. Even if China pushed its domestic suppliers to breach U.S. sanctions, they could not produce the sophistication and volume of chipsets required. If there’s a secret, so to speak, it’s that Huawei seems to be contemplating a change in the relationship it now enjoys with those 600 million smartphone users around the world. One that would bypass U.S. sanctions.

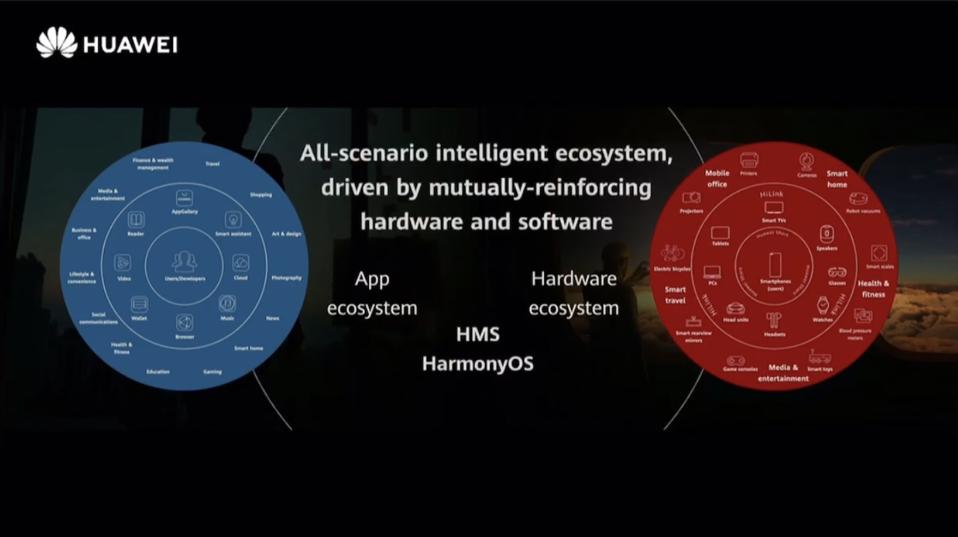

Yu’s punchlines were all HMS-related. This is Huawei’s answer to Google’s Mobile Services (GMS), everything from the Play Store to Google Pay, as well as stock apps for maps, mail and search. Alongside HarmonyOS—a cross-platform operating system, HiLink—the networking ecosystem to connect Huawei devices to partner offerings, this is the new ecosystem intended to replace Android.

HDC 2020

HuaweiHuawei has been talking up its ecosystem for more than a year. A seamless, AI-driven linkage between smart devices. At the heart of this strategy is “1+8+n,” where “1” a user’s smartphone, “8” is the user’s smart devices—PC, tablet, wearables, and “n” is the myriad other IoT devices that link into this ecosystem, controlled by that central Huawei hardware.

The latest expansion of the U.S. blacklist has hit Huawei’s strategy with a fatal flaw. Tricky to deploy a strategy with a smartphone at its heart if you can’t produce the smartphone. But what if the smartphone isn’t from Huawei, it’s powered by Huawei? An open-source operating system like Android’s AOSP, available to other manufacturers? Through this lens, the integration between HarmonyOS (out of the box IoT ready) and HMS (490 million active users, 261 billion app downloads) becomes more than a stick-on Google replacement.

“The growth [of HMS] is really fast,” Yu told HDC. “The development has exceeded our expectations.” HMS Core 5.0 is the latest iteration. Faster networking than Android and with lower latency, more API’s than Google’s GMS. If you want to build an ecosystem to compete with the world leader then this is important stuff. But how do you get partners to play along—Android isn’t broken, it’s a global powerhouse. Huawei’s experience in post-blacklist export sales tells you all you need to know about Android’s lock on the market.

Huawei’s answer is to play the China card. “Huawei would like to enjoy joint success with global partners and developers,” Yu explained. “We are dedicated to introducing Chinese developers to global consumers. We are hoping to see more TikToks in the future—so we can take them to the overseas market... At the same time, Huawei has the ambition to help overseas developers serve Chinese consumers.”

The China card. If you buy into the splinternet, the tech division that is being driven between east and west, then the macro opportunity for Huawei has always been to lead a new and united eastern alternative to the U.S. dominance of the mobile ecosystem. As I said last year, not long after the blacklist, if Huawei were to pass a point of no return on Google, then its long-game alternative would be to place itself at the beachhead for this new momentum, one supported by China’s own emerging technology strategy. And now here we are.

Looking at the potential for this balkanisation, competing operating systems and ecosystems, Yu told his audience that “we would like to be the bridge in-between.” The SDK for HarmonyOS 2.0, the smartphone-ready flavour is due by year-end, Yu said. The consumer boss has promised this before. Just after the blacklist, he said HarmonyOS (HongMeng as was) might be available before the end of 2019. That became 2020. Now it has become 2021. But the stakes have changed. This isn’t about posturing anymore, this is about survival.

Wang Chenglu—Huawei’s software boss, told HDC that the company has learned lessons a year into its own OS. “Developing a good ecosystem is far harder than developing good technologies... We don't have along history of software development in China.”

Beyond consumer adoption, weaning millions off Google, the challenge for Huawei is to get its domestic rivals to play ball. No mean feat given there’s no Google-shaped burning platform for them to jump from to maintain their export sales. But China will push and cajole. This could fast become a national strategy. “I hope developers and partners can unite with us in this historic moment,” Wang said, “in this way a Chinese ecosystem can be long-lasting and thriving... Today we are taking the first step.”

Huawei’s smartphone-centric ecosystem was born out of its premium devices that competed head-to-head with Samsung and Apple. The thought that this ecosystem might now be launched onto a market absent those flagships is a twist that was never envisaged until last month. And Huawei users will not be expecting that as a potential outcome from next year—even now, Chinese consumers are snapping up Huawei devices, fearing supplies will run out early next year.

Most HDC write-ups have focused on the news that, finally, Huawei has confirmed that HarmonyOS is getting prepped for smartphones and will be a replacement for Android. “Maybe starting from next year we will see smartphones with HarmonyOS,” Yu told the developer conference. The question as to who will make those smartphones, though, might be much more important.

If—and it’s a huge if—Huawei can coral Chinese (and maybe even non-Chinese?) smartphone makers to jump from Android to its own operating system and app store, it will be a massive achievement. It will also be a serious threat to Google’s lock on the Android market and to market-leader Samsung. Again, though, let’s not be too hasty with any predictions. We haven’t even started a debate yet as to whether the U.S. would go so far as to sanction manufacturers who opt for Huawei’s OS.

The Link LonkSeptember 20, 2020 at 04:49PM

https://ift.tt/3cgAEsD

Huawei Launches ‘Historic’ New Strike At Android To Beat Google And Samsung - Forbes

https://ift.tt/3eIwkCL

Huawei

No comments:

Post a Comment