- “The bedrock of this capital market system is high quality, reliable financial statements. This is indisputable. Without high quality and reliable financial information, capital markets do not function well. In turn, confidence in the quality and reliability of financial statements is driven by a combination of quality audit services and regulatory oversight.” – William D. Duhnke, Chairman of the PCAOB

A pedestrian talks on his phone while he walking past a Huawei store in Beijing on January 30, 2019. ... [+]

AFP via Getty ImagesHuawei is under siege. Something like half of the global market for 5G infrastructure outside China is apparently closed to them, at least for now. They’ve become tangled and mangled in the geopolitical strife between China and the United States. Criminal charges are pending here against the company and its officers. The CFO is under house arrest in Canada. Congress is restive. The White House is fulminating. The U.S. is trying hard to choke off the company’s supply chain. A whole lot of people don’t entirely trust Huawei or the information it provides about itself. Retaliatory threats and wolf warrior diplomacy by Beijing have further alienated customers and governments in the West.

Business-as-usual isn’t going so well. One must assume (or at least hope, for the company’s sake) that some sort of Big Re-Think is underway in Shenzhen.

In that spirit – in a previous column I proposed a Five-Point Plan to rebuild trust and begin to restore Huawei’s international standing. This Plan was offered “in the abstract”– without specific knowledge of the inner workings of the company. I will accept that it must be in many respects “naive.” Some of the proposals are now said to be “impossible.” That may be. (It may also be that with time the limits of possibility will expand.) But I think some of the suggestions are practicable, albeit not without some breaking of eggs…

Perhaps the simplest idea involves an unusual branch of the American financial regulatory system, the Public Company Accounting Oversight Board, known by its acronym PCAOB –– usually pronounced “Peekaboo.”

What is “Peekaboo”?

The PCAOB is essentially a “subsidiary” of the Securities & Exchange Commission (the Federal Reserve and the Treasury Department both have a hand in game as well). PCAOB was created by Congress in 2002 in response to the Enron scandal, which involved serious accounting and auditing failures. The accounting industry’s then-prevailing regime of self-regulation was seen as inadequate. PCAOB was designed to oversee, standardize and regulate the auditing process for U.S. public companies.

As a matter of law, every company traded on the New York Stock Exchange or NASDAQ is subject to PCAOB oversight of its audits, regardless of its home country. PCAOB has a global reach. It exercises oversight for firms based in Canada, Mexico, Scandinavia, Germany, Italy, Russia, India, Australia, South Africa, Nigeria… PCAOB has international agreements with dozens of countries, to address both the supervision of American multinationals operating in various foreign jurisdictions, and the needs of foreign firms seeking access to American capital markets. PCAOB has become a part of the U.S. financial hegemony, projecting the standards of our capital markets around the world.

Peekaboo’s China Problem

Except – not quite. China does not allow Chinese firms and auditors to cooperate with the PCAOB. They are the only major country that takes this stand. In its publication entitled “China-Related Access Challenges” the PCAOB states

- “Positions taken by Chinese authorities impede our ability to oversee audit firms in mainland China and Hong Kong. Specifically, these positions impair our ability to conduct inspections and investigations of the audits of public companies with China-based operations and whether we will obtain access remains an open issue. This affects our ability to oversee audit work on behalf of investors in U.S. capital markets.”

- “The PCAOB spent significant time and resources negotiating a Memorandum of Understanding (MOU) with the Chinese authorities for enforcement cooperation. Unfortunately, since signing the MOU in 2013, Chinese cooperation has not been sufficient … nor have consultations undertaken through the MOU resulted in improvements.”

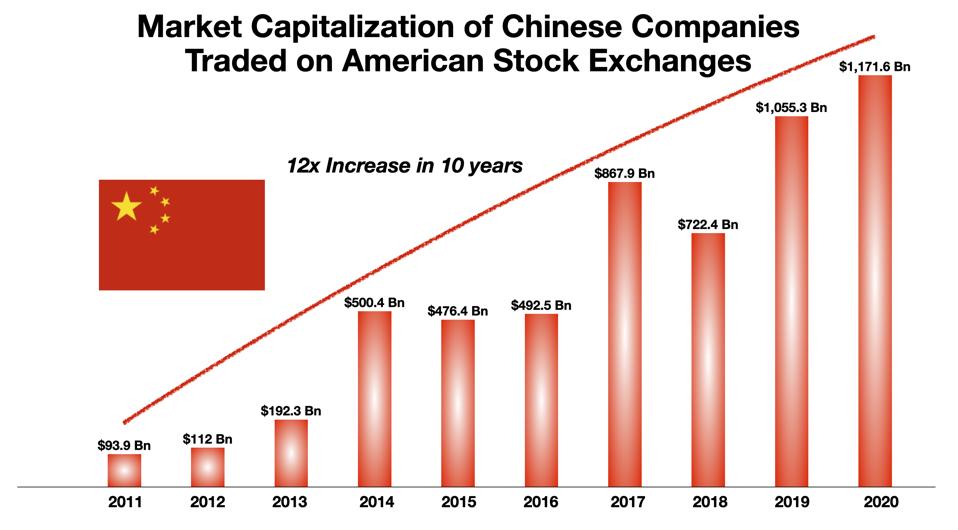

Despite this, Chinese firms have flocked to U.S. exchanges. There are today 138 Chinese companies listed on NYSE and Nasdaq NDAQ – more than twice as many companies as from the UK, Germany, France, and Italy combined – and there are another 152 Chinese companies trading on the Over-The-Counter Market. The China contingent makes up 3.3% of the total market capitalization of the U.S. stock market, approximately $1.2 Trillion – up by a factor of 12 in the last 10 years.

Chinese companies trading in New York - Market Capitalization

Chart by authorThere are good reasons for Chinese firms to want to list in New York. As the head of the PCAOB has written:

- “There is extensive evidence that these non-U.S. companies experienced reduced cost of capital, increased liquidity, and increased visibility after cross-listing in the United States. [In particular] there is extensive evidence that the quality of accounting information affects a company’s cost of capital.”

And so, an anomalous situation has developed. American companies trading in the U.S. are subject to PCAOB oversight. But Chinese companies have somehow been excused from compliance for years, despite the fact that they have experienced some of the most egregious accounting and auditing failures. Luckin – the Chinese would-be Starbucks SBUX -killer, listed on Nasdaq until recently – was the latest scandal, involving a massive accounting fraud, hundreds of millions of dollars of phony billings, and a know-nothing auditor. In the sorry aftermath, Ernst & Young’s Chinese affiliate offered this self-assessment:

- “EY was found to be prudent and independent, having strictly complied with all professional ethics and standards…[and] should not be held responsible.”

(Note the passive voice, to imply some sort of independent oversight – which is at best a heavy spin on what actually happened. The company self-investigated, inconclusively, and is still under intense scrutiny by various “Chinese authorities” as well as the SEC.)

The SEC – as the PCAOB’s parent – is also hamstrung:

- “Dozens of Chinese companies have collectively raised tens of billions of dollars from U.S. stock sales in the past few years, but the SEC says its ability to enforce investor-protection laws across national borders is limited.”

- “For years, the Securities and Exchange Commission and the Public Company Accounting Oversight Board have been unable to inspect audits of Chinese companies whose securities trade on U.S. stock exchanges. That has prevented them from getting information needed to bring enforcement actions against companies that may have engaged in securities fraud.”

The consequences of this gaping hole in the regulatory net are significant.

- “U.S. investors have lost billions of dollars [from] scandals involving U.S.- listed Chinese companies that auditors have alleged misrepresented their business and financial position. … the depth of frustration among U.S. regulators, who have been unable to enforce U.S. securities laws in China despite large numbers of Chinese firms having listed on U.S. exchanges…[The problem is compounded by] Beijing’s refusal to allow them to vet the quality of audits carried out by accounting firms in China.”

Audit standards, supervision, quality control – this is precisely the sort of oversight that the PCAOB was set up to perform. But American regulators have dithered over this problem for a decade.

The matter should be uncontroversial. PCAOB regulations do not target China. They are politically neutral regulations designed to enhance investor protections in our capital markets. The principle of abiding by local law – in this case, U.S. law – should prevail. Chinese and other foreign companies listing in New York should play by the same rules that apply to American companies.

Congress has taken up the question, proposing legislation to force U.S-listed Chinese companies to comply, or face delisting. The measure passed the Senate unanimously in May. This week, the White House issued an endorsement of the proposal by the President’s Working Group on Financial Markets. The wheels are turning. This loophole will close soon.

How Does this Relate to Huawei?

Good question. Huawei is not a public company. It is not listed on the NYSE or Nasdaq. It has no stated plans to go public in NY or anywhere else. Thus, it is not subject to PCAOB requirements. But the situation may offer an opportunity for Huawei to begin to build back trust among some of its skeptics in the West.

The idea is simple, probably too simple, but it could be a starting point: Huawei could petition the PCAOB to formally review the company’s audit process and results, with the goal of establishing a quality benchmark: de facto compliance with PCAOB auditing standards.

Could such a thing actually happen? What would it accomplish?

Is it Feasible?

As to the first question, a PCAOB audit-review would require the concurrence of (1) the PCAOB itself, and (2) the Chinese government.

Whether the PCAOB could be moved to undertake something outside its formal remit… well, I don’t really know the answer to that. But one could imagine that in the Big Picture context of U.S./China relations, with Huawei stuck in the middle, if there were a willingness to allow Huawei to make such a demonstration in the interest of a larger settlement, perhaps an extraordinary accommodation could be arranged. The PCAOB has been creative in designing its many international relationships.

Whether the Chinese government would permit it… Well, as with all things that involve Beijing and the CCP, that question partakes of a higher uncertainty. There is, for example, a matter of Chinese law:

- “China instituted a new hurdle this year, implementing a law that prevents its citizens and companies from complying with overseas securities regulators without the permission of its own market supervisor and various components of the Chinese government. The new law also gives China’s securities regulator power to regulate domestic companies’ overseas activities if they harm the interests of domestic investors.”

- “ ‘Even when a company wants to cooperate with an SEC investigation, it can no longer do so directly due to this new legal obstacle,’ said Paul Leder, a former director of the SEC’s Office of International Affairs.”

There is a “conflict of laws” here, a formal matter of considerable complexity, even in the abstract, and the particulars of this situation only add to the complexity and uncertainty. It is “probably improbable” that Beijing would quickly accede to any such request. They have been resisting this idea (PCAOB review) for years.

But – there might be a way around it. Huawei could undertake a “co-audit” – as explained in a recent Wall Street Journal article:

- “A co-audit is a second audit from an accounting firm whose records can be inspected by the accounting oversight board.”

- “Under such an approach, a U.S. accounting firm could conduct a ‘co-audit’ of a Chinese company’s financial statements alongside the audit performed by its Chinese affiliate. The board would theoretically have access to the work papers of the U.S. accounting firm, which would assume liability for any [inadequacies].”

- “Co-audits have been performed in other countries, senior SEC officials said.”

A co-audit might be a way to avoid a veto by Beijing.

What Would It Accomplish?

… a great deal, I think, symbolically and substantively.

If Huawei were allowed to conduct a PCAOB review, it would show (1) an important degree of independence from the Chinese government, (2) the willingness, as a global company, to play by global rules, and of course (3) – assuming the audit review would be positive, it would remove one of the specific concerns that critics of the company rely on to support their recommendations for aggressive countermeasures – the claim that the current audit is “a myth” and none of the financials can be trusted.

And if Beijing were to forbid it…

Plan B – Huawei should announce publicly its formal request for such a review, and let Beijing toss and turn as it may. Even if the government blocks the PCAOB gambit, it would still establish the credibility of Huawei’s intention. In fact, if the company takes some visible heat from the Chinese government over daring to make – and to publicize – such a request, so much the better. It would help make the case to the international audience that Huawei is not just the cat’s paw of Beijing in all things, and is in fact prepared to pay a price to be allowed to play — at some point – by international rules.

And one more thing — PCAOB approval increases the value of a company. Significantly. It also reduces the cost of raising capital, both debt and equity. Significantly.

The elaboration of this topic will be the subject of another column, but to cite just one study, in 2010 the PCAOB made a series of announcements explicitly calling attention, for the first time, to the difficulties they were facing in getting cooperation from the Chinese (and others). The market values of Chinese firms using non-cooperating local auditors fell by a market-adjusted 506 basis points in three days. Many major Chinese firms suffered declines measured in billions of dollars. The market understands the value of strong audit standards.

Huawei needs to build up trust in its financial reporting if it is to eventually recover the international standing it has lost in the last year. “Playing Peekaboo” an easy first step.

The Link LonkAugust 09, 2020 at 09:07PM

https://ift.tt/2DrldAU

A Huawei Recovery Plan, Step 1: Playing “Peekaboo” (PCAOB Compliance) - Forbes

https://ift.tt/3eIwkCL

Huawei

No comments:

Post a Comment