MADRID, SPAIN - 2019/04/03: A pedestrian talking on phone seen walking past a new Huawei store in ... [+]

LightRocket via Getty ImagesUnder Siege

Huawei is in a tough spot. They face major legal and political challenges. They have been cited for serious technical deficiencies. Their supply chain is being choked off by U.S. sanctions. And now comes the ban in Britain, with similar leanings elsewhere (Australia, Canada, France). India is weighing a ban. Germany – the lynchpin of their EU market prospects – is wavering. (The breaking news this week is that Deutsche Telekom has apparently decided to go with Ericsson, after having been firmly in the Huawei camp just a short while ago.) Japan is moving in that direction for government contracts, and private operators there are said to be following. Huawei has said, with some exaggeration, that its “survival” is at stake. – by which they mean their survival as an international market leader (they will always have a share of the Chinese domestic market).

The company is beleaguered, indicted, interdicted. Is there anything they could do to recover?

Yes there is – although whether they would… is another question. The company would have to take some bold steps and change some bad habits. But to examine the possibility, I have laid out below – in all immodesty – my own proposed Five-Point Plan. (Think of these points as elements of a Consent Decree, perhaps.)

(My disclaimer: I have no inside information related to Huawei. I have never done personal business with them, and I have been not spent much time in China. I do have a background in the wireless industry, but my proposals here are generic to modern business practice, and/or a sort of common sense, I think. Which is not to say that any of them have a practical chance of being adopted. That is up to others.)

A Five-Point Plan for Saving Huawei

1. Financial Standards

To start with an easy one…

Re Accounting Standards: Huawei currently provides financial statements that comply with international accounting standards (IFRS), audited by KPMG – one of the “Big Four” global accounting firms. So far so good, perhaps.

But consider the context. Chinese firms’ accounting practices are often inadequate, and occasionally fraudulent (the Luckin scandal). Chinese companies listed on American exchanges (like Luckin) are in principle subject to review by the Public Company Accounting Oversight Board (PCAOB), “a nonprofit corporation created by the Sarbanes-Oxley Act of 2002 to oversee the audits of public companies and other issuers in order to protect the interests of investors and further the public interest in the preparation of informative, accurate and independent audit reports.” The requirement has not been enforced. The Chinese government has blocked the PCAOB from exercising its function for Chinese companies listed on American stock exchanges:

- “Chinese state security laws bar the PCAOB from reviewing the work papers from Chinese auditors, removing effective oversight over those auditors and the quality of work produced on Chinese firms and foreign affiliates’ operations in China.”

Huawei is not listed, so it doesn’t affect them directly. But the taint of weak accounting for Chinese firms sticks to them, by association. Huawei’s “KPMG audit” was actually performed by KPMG Huazhen, an independent Chinese affiliate. KPMG Huazhen has had some considerable trouble with the courts in Hong Kong over Chinese corporate accounting scandals, and are said to “face a myriad of legal and regulatory problems” in China. (The KPMG issue may be systemic: KPMG affiliates have also been the subject of “harsh” criticism by the regulatory authorities in the US and the UK for the “poor quality” of its audits.)

Finally, there is the view of the U.S. State Department, which claims that Huawei’s audit is a “myth” –

- “Huawei does not permit external audits, so the true health of the company—including sales and profits—cannot be objectively verified.”

It’s hard to square all these assertions. Is the Huawei audit “real”? Is it of true “Big Four” quality? Or is it an evasion? The answer is that it doesn’t matter, because for the smoke-means-fire party, the accusation sticks.

The recommendation, therefore: Huawei should request the Chinese government for a waiver to allow PCAOB to review KPMG’s audit. They should also invite an additional audit review by a different firm – not KPMG, and not based in China.

Huawei should also publicize the waiver request, even in the face of Beijing’s likely disapproval, and actively lobby the government to permit it – if not as a general change of policy, then at least as a “special exception” in light of Huawei’s current difficulties. Prove the State Department wrong. Why not?

2. Credit Ratings

Another easy one.

Huawei currently obtains its credit ratings from a domestic Chinese credit rating agency. But the standards used by Chinese rating agencies are not equivalent to global ratings standards.

- “Chinese and foreign investors have long regarded Chinese ratings agencies with suspicion, noting that they generally grant higher ratings than foreign counterparts on the same companies.”

Global agencies like Standard & Poor’s, Moody’s and Fitch rate Chinese bonds issued offshore six to seven notches lower than Chinese ratings on the same debt issues. This contributes to the reputational problem for Chinese firms generally – their credit risk, as reflected in the dubious ratings of the domestic agencies, is not clear. In 2018, the second largest Chinese credit rating agency was suspended for malpractice.

- “A spokesman for the China Securities Regulatory Commission said at the agency’s weekly press conference said that onsite inspections of Dagong had revealed “chaotic management”, high fees charged to issuers for “consulting services”, unqualified senior management, and problems with financial models used in bond ratings.”

The largest Chinese rating agency – the one used by Huawei – was cited in the same action (though not banned) for “poor quality control of its rating process.”

There is thus pressure to allow the global rating agencies to operate freely in China. S&P recently gained approval to do business there.

- “ ‘The feedback we receive from market participants is that there is real hunger for greater granularity in domestic Chinese ratings, and for ratings that are determined in a transparent and rigorous way,’ [said] Simon Jin, CEO of S&P Global (China) Ratings.”

“Hunger for greater granularity” is a euphemism. Chinese-rated “credit,” ironically, simply lacks credibility.

The recommendation: Huawei should ask to have its credit rated by the three global rating agencies, according to the global standards.

There are two advantages to be gained by this move.

First, it would bring Huawei inside the global framework for measuring credit quality. Huawei’s credit is probably quite good, but their rating is dodgy because of the dodginess of the local rating industry.

Second, the credit rating process – as performed by the global firms like S&P and Moody’s – is another form of “audit” — which is in some ways more demanding and more substantive than an accounting audit, because it also considers the nature and viability of the company’s strategy and the competitive market environment. That is the real value here for Huawei – a proper credit review is another way to objectively validate its business.

3. A Security Firewall

The number one stated concern of most Western governments is the possibility that information passing through Huawei’s networks could be accessed by the Chinese government. Huawei has said this won’t happen, but the company is subject (as are all Chinese companies, by law) to forced cooperation with the Chinese military intelligence service. Words and pledges won’t make this issue go away.

The recommendation: Huawei should construct its own firewall (something the Chinese are good at) to interpose between its equipment and the Chinese security apparatus and block the transfer of user information. This firewall should be open to inspection and validation by outside authorities.

(Of course Beijing won’t like this idea, but Huawei can publicize its proposal and undertake the work to demonstrate the capability – while it negotiates the terms of implementation with the Chinese government.)

(It’s also worth noting that American companies like Apple have been able to secure their customers’ user data from prying by the U.S. government. Although controversial politically, it proves that it is technically feasible for a tech-savvy company to build a strong security barrier of this sort.)

4. Euthanize the “Wolf Culture”

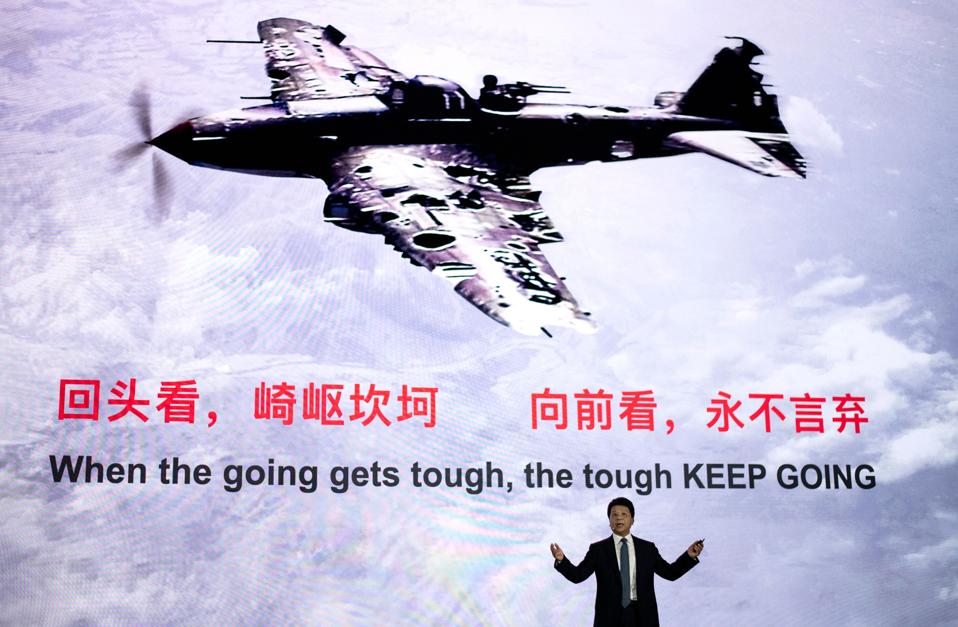

Huawei rotating chairman Guo Ping speaks during the Huawei Global Analyst Summit 2020 at the Huawei ... [+]

AFP via Getty ImagesHuawei sprang from a military origin. It has retained a militaristic outlook, and there is a warlike tone in much of its messaging.

Huawei calls this “wolf culture” — as in this excerpt from a Huawei-supported blog:

- “The culture of Huawei Company is known as ‘wolf-culture’. The first character of wolves is bloodthirsty. … The second character of wolves is resistance to cold…. The third character of wolves is taking actions in [packs]. … Overall, it’s no doubt that the ‘wolf-culture’ is the cornerstone of success for Huawei…”

The Washington Post reports on how this culture is propagated:

- “Orientation camps are not uncommon in the Chinese business world. But Huawei is in a league of its own. New employees at the company’s headquarters in Shenzhen must undergo a two-week boot camp at Huawei University, the company’s training institute, complete with sessions that are literally called “brainwashing”… They sleep in a dormitory and wake up every day at 5 a.m. for running and exercises in red-and-white Huawei uniforms. Then come classes about history, company products and its corporate culture — which, they learn, is “bloodthirsty” like a wolf…”

It must be fun, to dress up business like real combat. It is intended (one supposes) to be inspirational. Ren Zhengfei (the company’s founder) declared of the recent travails that “the company has entered a state of war.” He compared the UK dispute with “the battle of Stalingrad.” An American admirer, writing in The Harvard Business Review, reports that:

- “a favorite slogan in the early days of Huawei: We shall drink to our heart’s content to celebrate our success but if we should fail let’s fight to our utmost until we all die…”

Ok, just metaphors, military poetry, pro patria mori… but tough talk can become more than that, fostering a general belligerency, a habit of responding to critics with threats and worse. Huawei may not have detained the Canadian hostages, but the world sort of thinks yes they did. And really, isn’t “wolf culture” more appropriate to the adolescent phase of a company’s development, when it has to fight powerful incumbents for a seat at the table? It is unbecoming for the global leader (which Huawei has become) to continue this way. They need to win respectability and build friendly relations with skeptical customers and more skeptical governments. Business-as-war doesn’t work very well in the 21st century.

The recommendation: Put “wolf culture” on the shelf, and recognize that the company needs to act and be seen more like a public utility, staid and reliable and unthreatening, like the old AT&T or IBM, as Swedish-dull as Ericsson (rather than like a panzergruppe headed into Stalingrad).

5. Clarify the Darn Ownership Structure

“Who Owns Huawei?” – the question everyone asks… An analysis and a fuller answer will require another column. But we can summarize the opposing views.

The company says that Huawei is employee-owned. 100,000 happy capitalists. Probably a lot of millionaires. Just like Microsoft, more or less….

The prevailing opinion in Western circles is that Huawei is either owned or controlled by the CCP. In a widely cited recent scholarly paper, the authors conclude that “Huawei may be deemed effectively state-owned.”

Whatever the truth of this “murky matter” (as the New York Times called it), one thing is clear: The Huawei story is not sticking. Just repeating the “employee-owned” formula will not convince the doubters at this point.

The Recommendation (interim version): Huawei should invite an international team of business, legal and corporate governance experts to review the current structure in detail, with full access to all the appropriate information, charged with producing a thorough and honest report of the currents state of affairs.

The Better Recommendation: Huawei should consider how to restructure itself so as to bring its ownership arrangements into line with a more comprehensible and transparent structure. Whether this involves creating a public company, or a hybrid with multiple share classes, or a partnership, or a state-owned enterprise – there are many options… perhaps the answer would flow from the interim study suggested above.

6. Laissez-Faire

Well, OK, the 6th point is a bonus. It is also the most difficult. And the most important because without it, the rest won’t work.

Huawei’s relationship with the Chinese government has to change. The company needs to stand up to the Chinese authorities, and assert its commercial independence from the state’s geopolitical agenda.

Easier said, etc… and perhaps impossible, if the Chinese state really does “own” Huawei. But let’s consider the possibility. Huawei has reached the point where the price of not standing up is worse than the grief they will endure by asserting themselves. Perhaps one way to understand Huawei’s plight is to see the company as a victim – not of the West, but of the CCP. Huawei has benefited from Beijing’s protection and sponsorship. But the quid pro quo is becoming intolerable. The Chinese leadership does not understand laissez-faire – in the original sense of “leave me alone.” Instead, the CCP seems to see them as an instrument of its policy. Why else (why on earth!) would the company have dabbled in secret with North Korea? Or Iran (post-sanctions)? These can’t have been strategic markets from a business perspective. And look what those perhaps forced adventures have cost Huawei.

It is time for Huawei to become what they say they are. Stand up now. If we take the company’s self-characterization at face value, as they want us to, true to its outward clothing as a private company with a no controlling government ties – then show us! Take the heat. The world will rally to you.

The Link LonkJuly 24, 2020 at 07:18AM

https://ift.tt/39uHhGb

How Huawei Could Save Itself: A Five-Point Plan - Forbes

https://ift.tt/3eIwkCL

Huawei

No comments:

Post a Comment